Silver Can Be a Strategic Asset Within Efficient Multi-Asset Portfolios

(Washington, D.C. – September 29, 2022) – Silver as a distinct asset class should be considered as a strategic investment allocation within a global multi-asset portfolio, according to new research by Oxford Economics, a leading independent economic advisory firm. The firm finds that investors would benefit from an average 4-6 percent silver allocation within their portfolio, significantly higher than current holdings of silver by most institutional and individual investors.

The new report, “The Relevance of Silver in a Global Multi-Asset Portfolio,” was commissioned by the Silver Institute to explore the risk-adjusted returns of model portfolios with differing levels of silver exposure.

To examine the potential long-run benefits of holding silver in a portfolio, Oxford Economics compared silver’s historical performance with a range of traditional asset classes, including stocks, bonds, gold, and other commodities, from January 1999 to June 2022. Among the findings, silver was shown to have a relatively low historical correlation with asset classes other than gold, suggesting silver’s valuable diversification potential in investment portfolios.

Further, the firm conducted a more rigorous test to determine whether silver should have a consistent allocation alongside gold in a multi-asset portfolio by running dynamic portfolio optimization simulations. These simulations were run with the aim of maximizing the risk-adjusted returns of a mixed-asset portfolio under varying constraints designed to reflect differing investor risk preferences. Across the historic sample period, the authors found the average optimal allocation to silver was in the range of 4-5 percent for a portfolio with a five-year holding period.

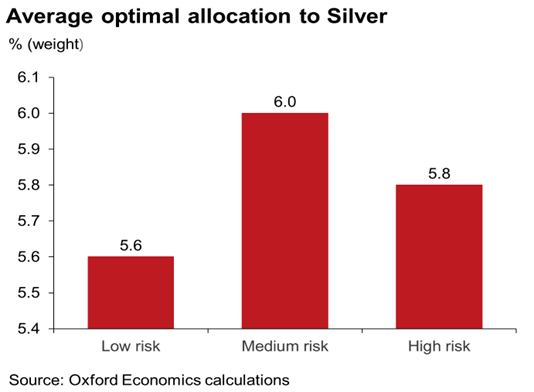

Optimal allocations to silver by risk threshold (2022 – 2032)

While silver’s price movements are often closely correlated with gold, Oxford Economics’ analysis suggests that silver’s return characteristics are sufficiently different from gold to make it a valuable diversification tool that deserves its own portfolio commitment. With over half of global silver demand used in industrial applications, the price of silver tends to be more sensitive than gold to trends in the global industrial cycle, contributing to its higher volatility. Moreover, silver is likely to benefit from an increasingly positive structural demand outlook over the medium term, given its use in many green technologies, indicating that we may be entering a period where the gold-silver price ratio shifts back in favor of silver.

Based on their projections for asset returns, Oxford Economics investigated the potential behavior of silver relative to other asset classes and its role in an optimal portfolio over the next decade. This analysis suggests an even higher optimal portfolio allocation to silver of around 6 percent would be warranted over this period.

A complimentary copy of the report can be found here.

# # #

The Silver Institute is the silver industry’s primary voice in expanding public awareness of silver’s essential role in today’s world. Its mandates are to provide the global market with reliable statistics and information on silver and create and execute programs that help drive silver demand. For more information on silver and its many facets, please visit www.silverinstitute.org.

Disclaimer

This press release and report are not to be construed as a solicitation or an offer to buy or sell silver or related products, securities, or related investments, and nor does it constitute advice in relation to the buying or selling of the same. You should obtain professional or specialist investment advice before taking, or refraining from, any action related to the content of this press release. This report may contain forward-looking statements that are subject to risks and uncertainties. Forward-looking statements are based on information and assumptions that the Silver Institute and Oxford Economics had when those statements were made or their good faith belief as of that time with respect to future events. Forward-looking statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those in or suggested by the forward-looking statements. Except as required by law, the Silver Institute and Oxford Economics undertake no obligation to update publicly any forward-looking statements after the date of this report or to conform these statements to actual results. While consideration has been taken in preparing the information published in this report, the content is provided without any guarantees, conditions, or warranties as to its accuracy, completeness, or reliability.

Contact: Michael DiRienzo Lloyd Barton

The Silver Institute Oxford Economics

+1 202-725-7572 +44 1865-268-927

Recent Comments