The Silver Institute works with the Metals Focus team, a leading research company that is based in London, to prepare and publish a comprehensive report on the previous year’s silver supply and demand trends, with special emphasis on key markets and regions. This annual survey also includes current information on prices and leasing rates, mine production, silver trade, above ground stocks, and investment.

Material and statistics in this section were adapted in part from the Silver Institute’s World Silver Survey 2025.

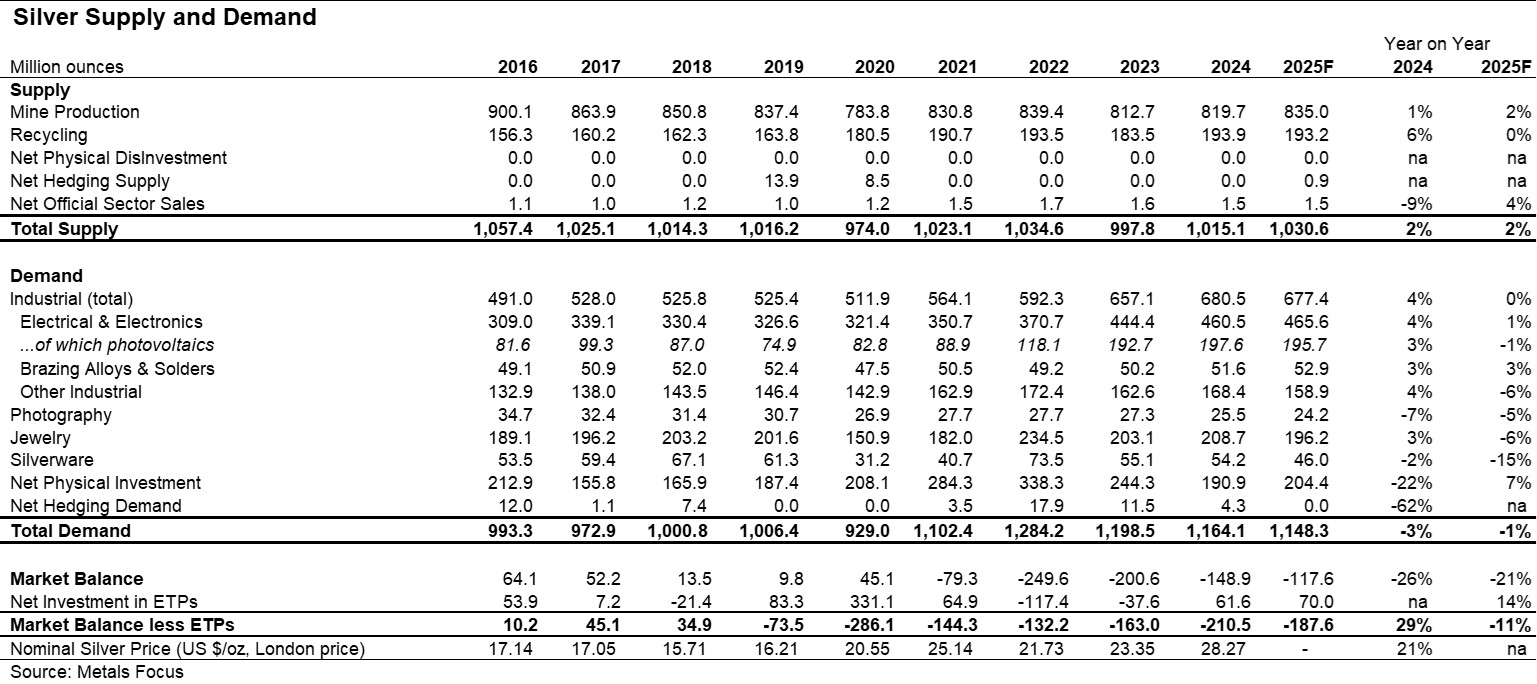

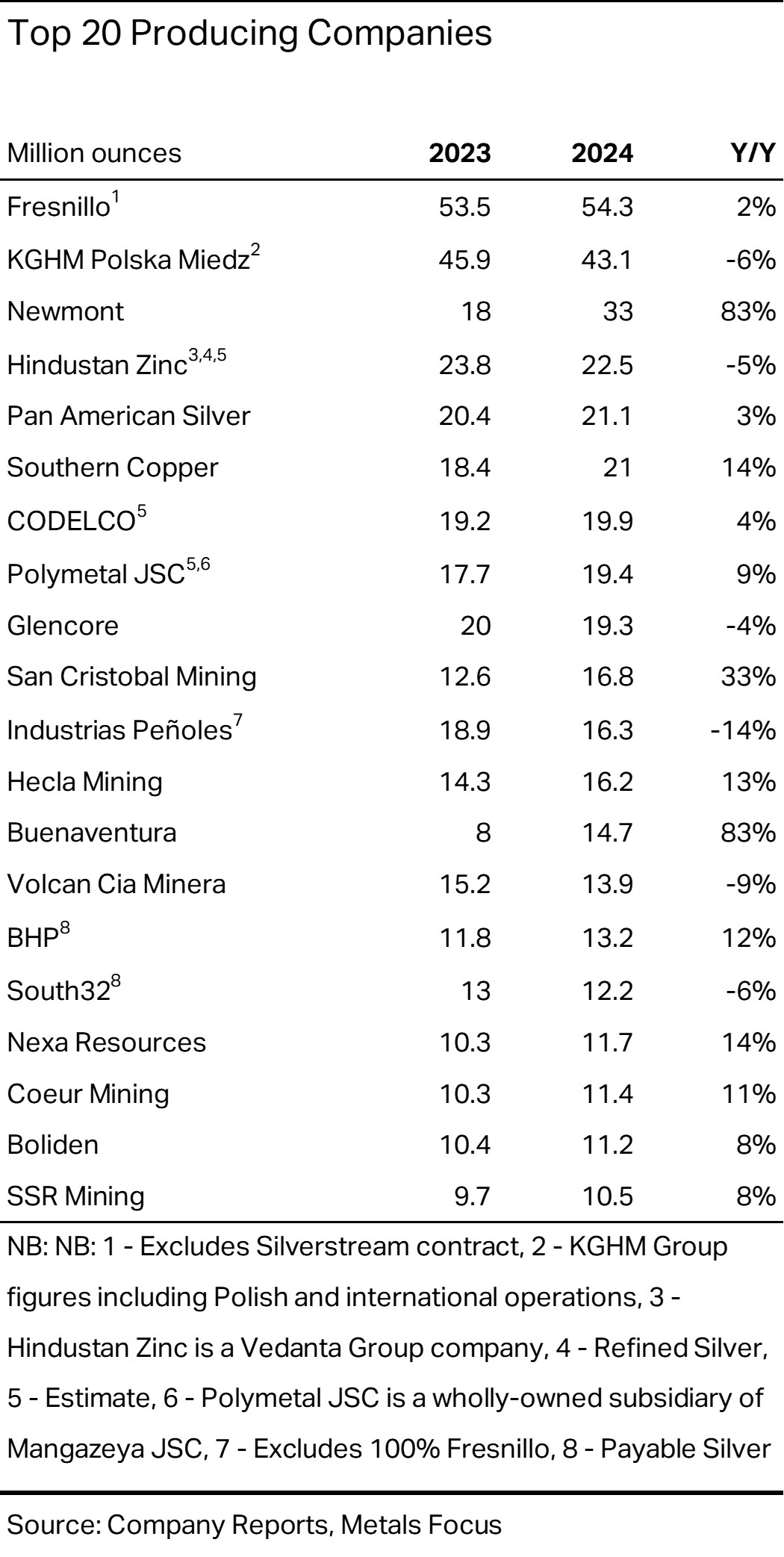

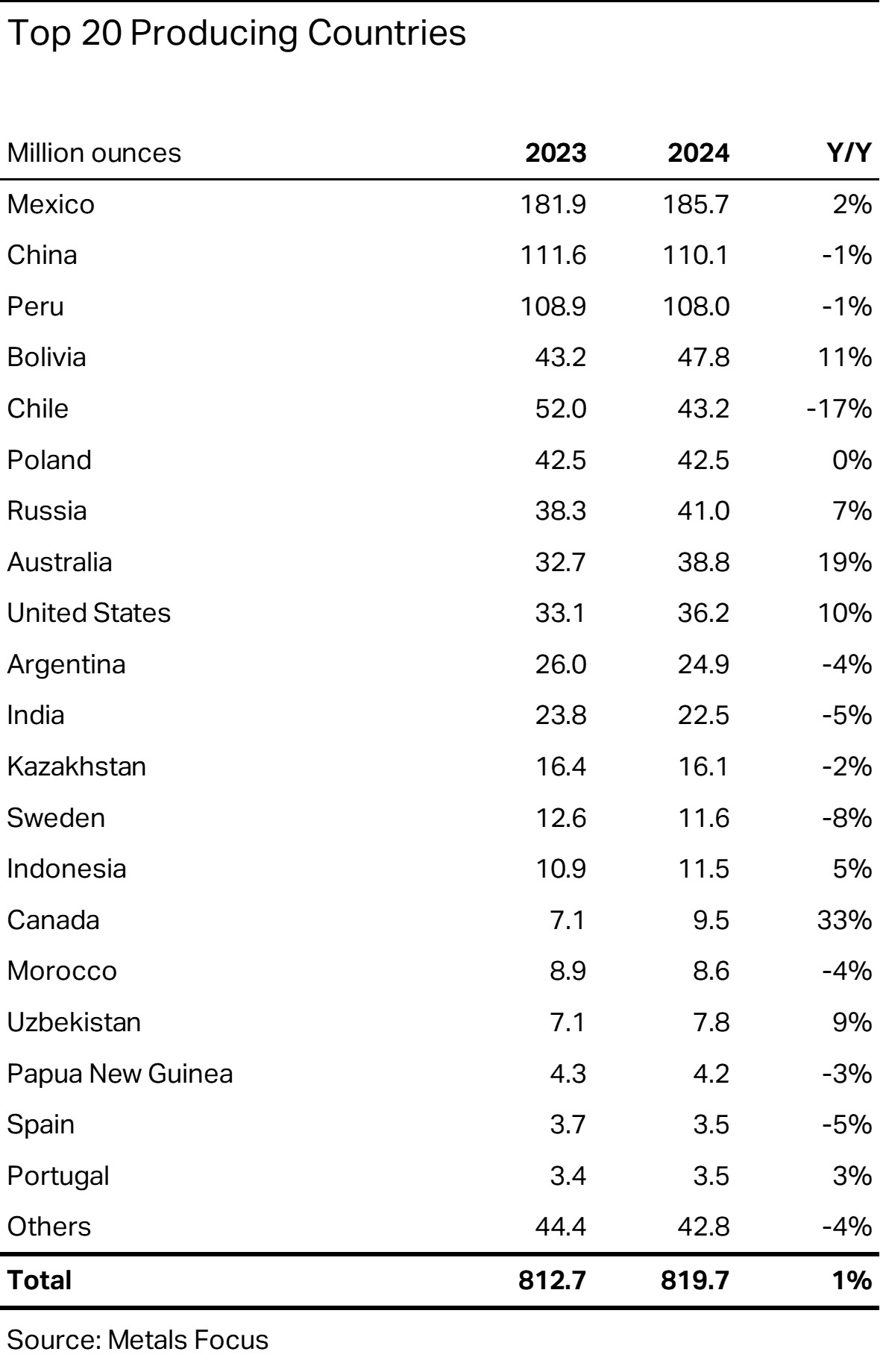

Mine Production

In 2024, global silver mine production rose by 0.9 percent to 819.7 Moz, underpinned by increased output from lead/zinc mines in Australia and the recovery of supply from Mexico, as Newmont’s Peñasquito mine returned to full production. This was supplemented by additional growth from Bolivia and the US. Lower output from Chile, down 8.8 Moz y/y, partially offset this growth.

Silver production from lead/zinc mines remained the dominant source of silver, but output was flat y/y. In contrast, silver production from gold mines recorded the strongest growth, up 12% y/y to 13.9 Moz, a three-year high.

Last year, Mexico remained the leading silver mine-producing country, followed by China, Peru, Bolivia, and Chile.

Material and statistics in this section were adapted in part from the Silver Institute’s World Silver Survey 2025.

Recycling

Recycling rose 6 percent in 2024, reaching a 12-year high of 193.9 Moz. Industrial scrap saw the most significant increase in weight terms, mainly led by the processing of spent EO catalysts. In percentage terms, the highest gain came from silverware recycling, which climbed by 11 percent as firmer silver prices and cost-of-living issues encouraged selling in Western markets.

Global Recycling

Material and statistics in this section were adapted in part from the Silver Institute’s World Silver Survey 2025.

Silver Demand

Total silver demand fell by 3 percent to 1.16 billion ounces (Boz) in 2024. The decline was primarily driven by weakness in physical investment and slightly lower silverware and photographic demand. The drop was partially offset by the continued strength of industrial demand, which enjoyed another record year. In keeping with 2023, growth was underpinned by record electronics & electrical demand. This reflected structural gains in the green economy flowing through from the PV and automotive sectors and grid infrastructure development. Demand also received a boost from AI-related applications. While thrifting and substitution remained limited across most sectors, notable advancements within the PV segment led to a sharp reduction in silver loadings.

Silverware demand in 2023 fell by 25 percent to 55.2 Moz. This mainly reflected an elevated base in 2022 when fabrication achieved a record high. As with jewelry, overall losses were almost entirely due to India, owing to high local silver prices.

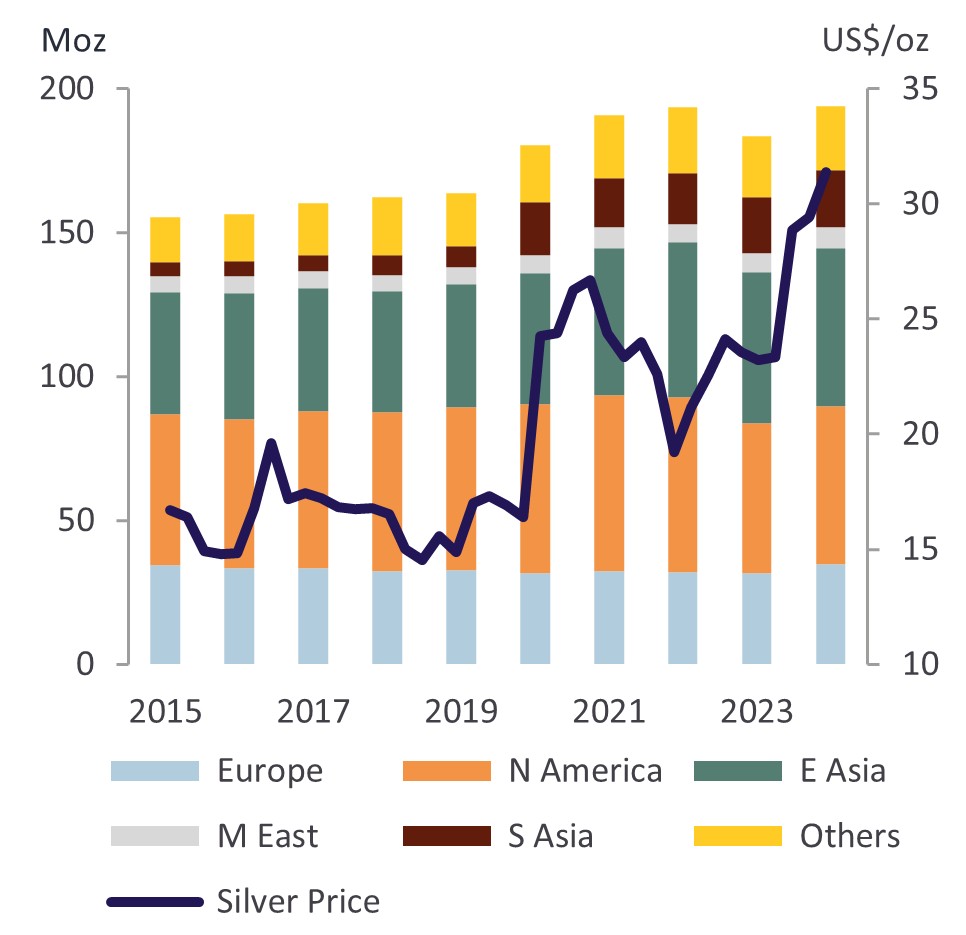

Silver Jewelry and Silverware

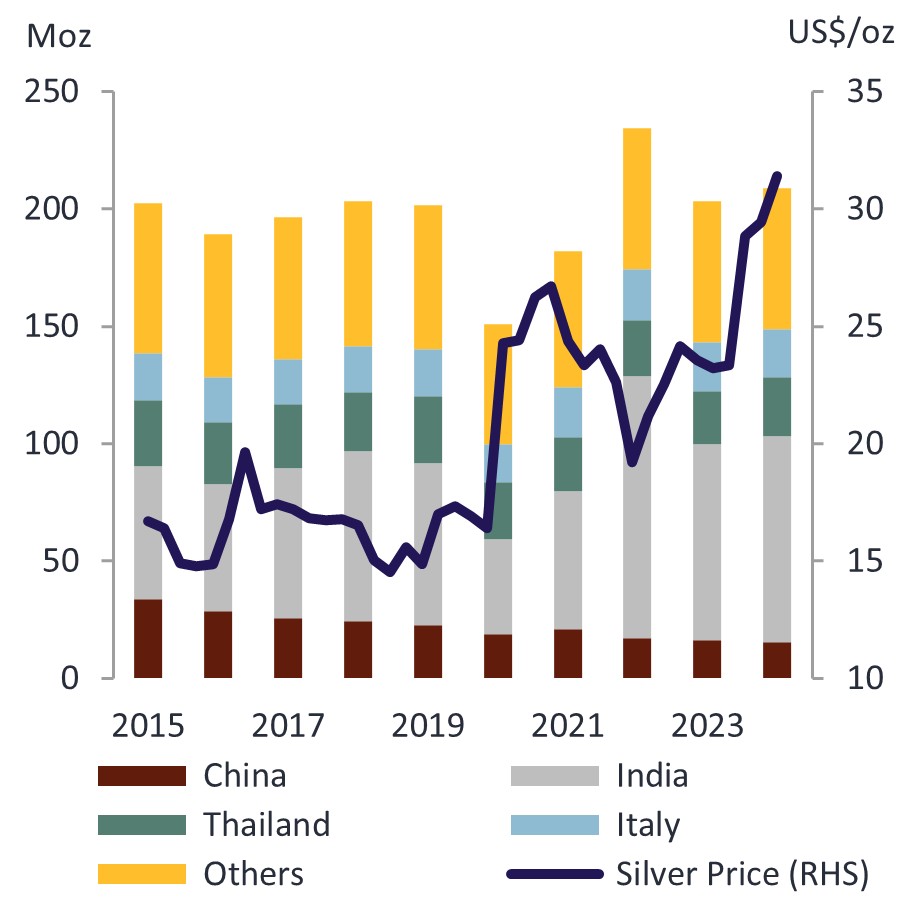

Silver jewelry fabrication grew by 3 percent to 208.7 Moz in 2024. India accounted for the bulk of these gains, thanks to such factors as the import duty cut, a healthy rural economy, and the ongoing rise in purities. Improving exports to key Western countries also lifted fabrication in Thailand by 13 percent. Western consumption was broadly steady as positives, such as branded silver’s gains, balanced negatives including cost-of-living issues. By contrast, China saw a third consecutive year of losses amid a challenging economic backdrop.

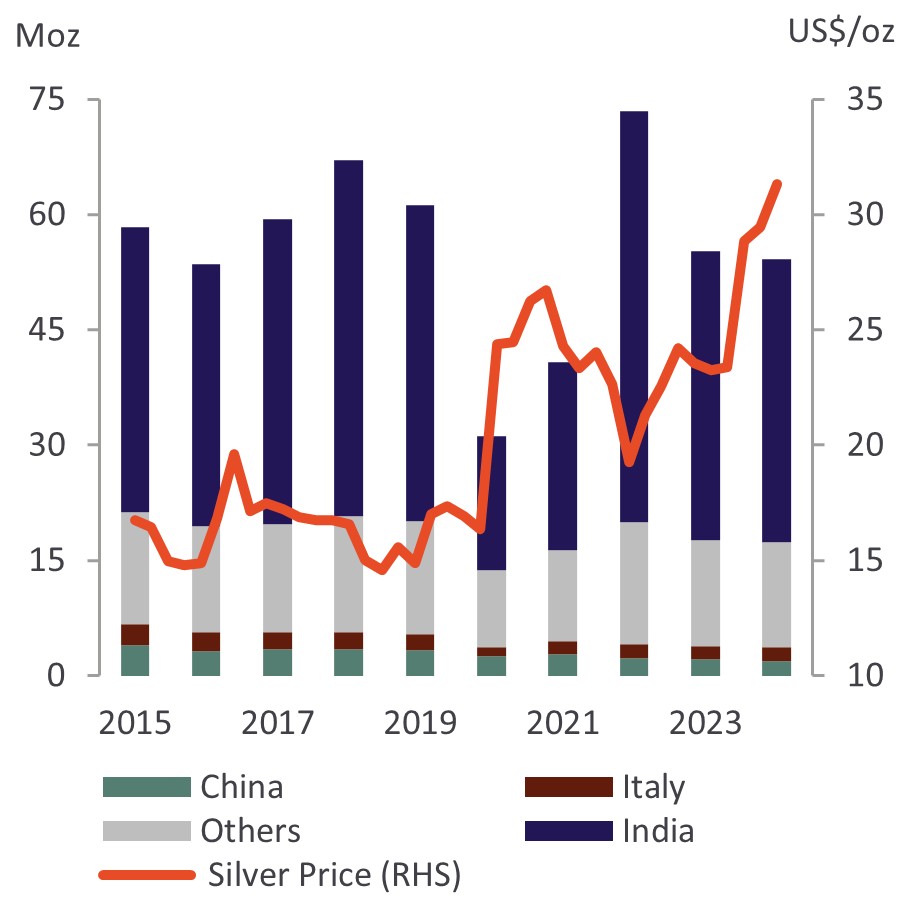

Silverware demand declined by 2 percent to a three-year low of 54.2 Moz. The drop was driven by softer demand in India, where elevated prices weighed on the gifting segment.

Global Silver Jewelry Fabrication

Global Silverware Fabrication

Material and statistics in this section were adapted in part from the Silver Institute’s World Silver Survey 2025.

Silver Mining in History

The story of silver mining began about 5,000 years ago.

Silver was first mined around 3,000 BCE in Anatolia, now located in modern-day Turkey. The precious metal helped early civilizations in the Near East, Ancient Greece to flourish.

In about 1,200 BCE the center of silver production shifted to Greece’s Laurium mines, where it continued to feed the region’s growing empires, even providing currency for ancient Athens. By about 100 CE, the center of silver mining moved to Spain, where the mines became a major supplier for the Roman Empire and an essential trading component along the Asian spice routes.

However, no other single event in silver’s history rivals the discovery by European conquerors of the white metal in the Americas following Columbus’s landing in the New World in 1492. The events that unfolded in the following years changed the face of silver and the world forever.

The Spanish conquest of the Americas led to an increase in the mining of silver that dramatically eclipsed anything that had come before that time. Between 1500 and 1800, Bolivia, Peru and Mexico accounted for over 85 percent of world silver production and trade as it bolstered Spanish influence in the New World and elsewhere.

Later, mining spread to other countries, most notably the United States with the discovery of the Comstock Lode in Nevada.

Silver production continued to expand worldwide, growing from 40 to 80 million ounces annually by the 1870s.

The period from 1876 to 1920 witnessed an explosion in both technological innovation and exploitation of new regions worldwide. Production over the last quarter of the 19th century quadrupled over the average of the first 75 years to a total of nearly 120 million ounces annually.

New silver discoveries in Australia, Central America and Europe added to total world silver production. The twenty years between 1900 and 1920 resulted in a 50 % increase in global production, and brought the total to about 190 million ounces annually. These increases were spurred by new discoveries in Canada, the United States, Africa, Mexico, Chile, Japan, and elsewhere.

During the 1900s, new mining techniques contributed to a massive rise in overall silver production. Breakthroughs included steam-assisted drilling, mine dewatering, and improved haulage. Further, advances in mining techniques enhanced the ability to separate silver from other ores and made it possible to handle larger volumes of material.

These new methods were critical to the increased volume of production, as many of the high-grade ores throughout the world had been largely used up by the end of the 19th century.

More than 5,000 years after ancient cultures first began to mine in relatively small amounts, silver mine production has now grown to almost 800 million ounces in 2019.